Plan Your Child’s Marriage on a Budget with Frugality

One of the most great honors in life is the path to plan your child’s marriage. It’s a love, tradition, and hope for the future tapestry. Still, in an age of rising costs and social media-driven expectations, this lovely rite of passage can become a source of great financial burden. The idea of a perfect day should not end in decades of debt. Learning how to plan your child’s marriage on a budget with frugality is not only a financial plan; it’s also a showing of love and knowledge.

In this sense, frugality is far from cheapness. It is the wise, deliberate distribution of resources aimed at maximizing happiness and meaning while minimizing waste. It’s about planning a day that feels abundant without going overboard. This manual gives the definitive, step-by-step approach you need whether you’re negotiating the last year or starting your wedding financial planning two decades ahead.

Every important step, setting up a wedding savings plan, carrying out affordable wedding planning, and mastering the financial discipline for big life events, this thorough resource will help you along the route. We will address urgent issues like how much should I save for my child’s wedding and how to prevent overspending on weddings and how to avoid overspending on wedding parties. With confidence, clarity, and calm, let’s start the trip to plan your child’s wedding on a budget.

The Foundational Pillar: Early and Disciplined Financial Strategy

The most significant determinant of your ability to plan your child’s marriage on a budget with frugality is not your income today, but the time you have and the discipline you apply. Proactive financial planning for child’s marriage transforms an overwhelming lump sum into manageable, growth-oriented steps.

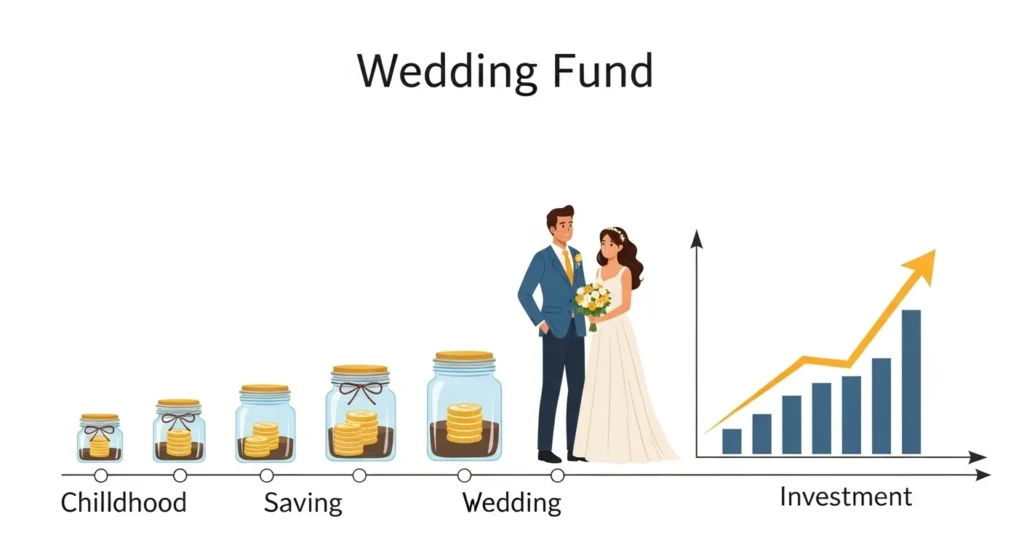

The Non-Negotiable First Step: Start Early for Child’s Marriage

Your strongest weapon is the compounding effect. Starting 15–20 years early on your wedding savings plan is radically different from beginning 5 years out. Early beginning helps you to create your wedding corpus by using market expansion and significantly lowers your monthly investment requirement.

Actionable Insight: Open a goal-labeled investment account right away. This psychological separation is essential for financial discipline for big life events and keeps the corpus from being diverted.

How to Rationally Estimate Marriage Costs and Build Your Target

A goal without a number is a wish. Your first concrete task is to rationally estimate marriage costs based on realistic, localized research.

1. Benchmark Current Expenses: Standard Research the scale and style you have in mind for typical wedding expenses in your city or area. This establishes your starting point.

2. Apply the Inflation Factor: One of the most important aspects in future wedding cost estimation. Traditionally, wedding expenses beat the overall rate of inflation. Under the assumption of a 6–8% yearly inflation impact on wedding cost, it is wise.

- Formula: Future cost equals present cost times (1 plus inflation rate) to years to goal.

- Example: With 15 years remaining at 7% inflation, a $30,000 wedding today turns out to be about $82,000. This is your intended marriage corpus.

3. Break Down Wedding Expense Categories: Develop a first wedding budget spreadsheet with every category: Venue, Catering, Attire, Photography, Decor, etc. This foresight is essential for wedding expense planning.

Implementing Your Goal-Based Investing Plan

Saving for a child’s wedding requires strategic asset allocation for marriage goals.

- The Growth Phase (10+ Years): for long-term objectives, give greatly to growth assets such as equity mutual funds for long-term goals. A disciplined investment approach (SIP) enables rupee-cost averaging advantages.

- The Transition Phase (5-7 Years): Start portfolio rebalancing as the goal gets close. To safeguard accrued capital, progressively transfer parts of the corpus to less volatile debt instruments.

- The Preservation Phase (1-3 Years): Keep money in capital-protective, liquid instruments. No dangerous moves; the capital must be available for vendor deposits.

Essential Buffer: The Contingency Fund for Wedding

Always earmark 10-15% of your total budget as a contingency fund for wedding. This covers unforeseen expenses, a quintessential part of smart marriage expense planning.

The Tactical Blueprint: Crafting Your Detailed Wedding Budget

With a growing financial corpus, the focus shifts to meticulous wedding budget planning. This is where the principle to plan your child’s marriage on a budget with frugality becomes operational.

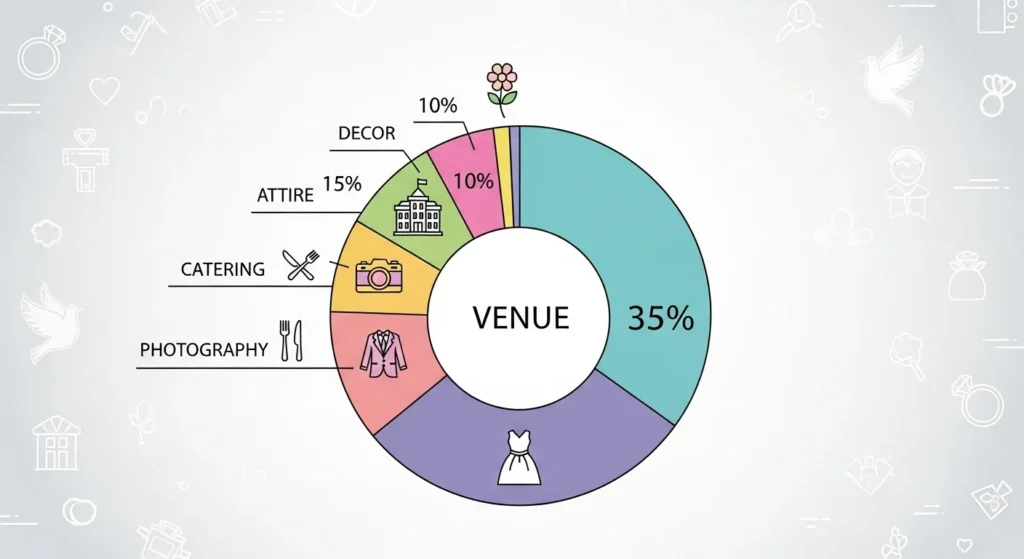

Creating Your Master Wedding Budget Breakdown

A percentage-based allocation provides a robust framework. Adjust based on personal priorities (e.g., prioritizing photography over florals).

- Venue & Catering (40-50%): The majority comes from venue and catering (40–50 percent), Includes service, food, drinks, and rental.

- Photography & Videography (10-15%): Investing in permanent memories requires a sensible allocation for wedding photography.

- Attire & Beauty (5-10%): Wedding clothing costs might include rentals, sample sales, or expert local tailors.

- Music/Entertainment (5-10%)

- Managing the wedding decoration budget skillfully: florals and decor (5–10%).

- Stationery and Planning (5%)

- Rings (2–5%)

- Miscellaneous & Contingency (10-15%)

How to Control Wedding Expenses: The Frugality Mindset in Action

Frugality is intentionality. Here’s how to apply it across major wedding expense categories:

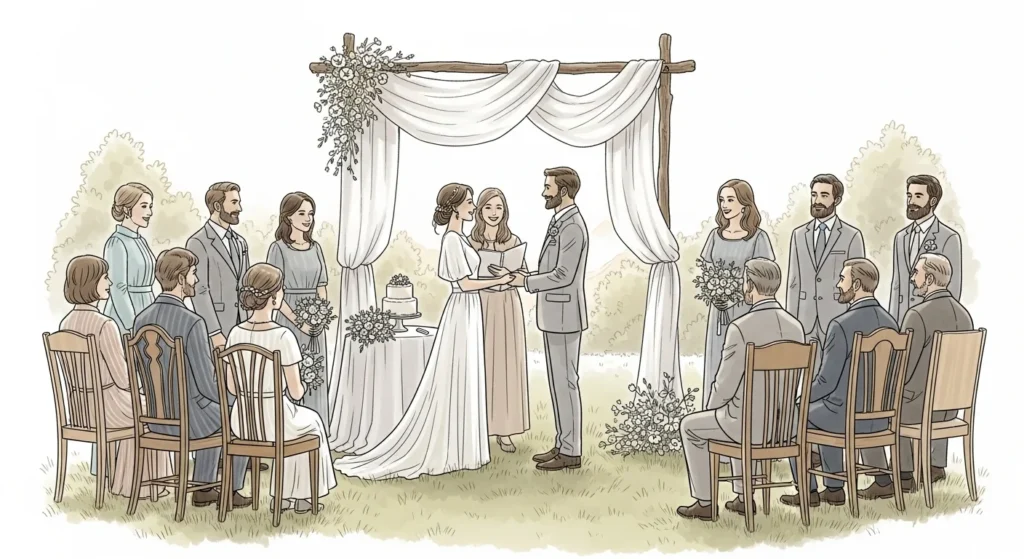

- Master Guest List Management: The one best cost control tool is master guest list management. Every visitor helps with stationery, favors, venue capacity, and catering. Be tough but courteous in selecting a small guest list.

- Reconsider the Location: Among Budget-friendly wedding venue options are:

- beautiful libraries, community halls, public parks with permits.

- Holding the reception and celebration at the same venue.

- Selecting a Friday/Sunday or an off-season day will save between 20 and 40%.

- Innovate Catering Cost Planning: Prefer buffet or family-style eating to plated service. Imagine a cocktail-style party with plenty of hors d’oeuvres. Restrict the bar to beer, wine, and a distinctive drink.

- Embrace Digital and DIY: Utilize a wedding website and digital invitations. For wedding decor budget projects utilizing sustainable, leased, or borrowed objects, gather imaginative buddies.

The Execution Toolkit: Your Wedding Budget Spreadsheet

Your wedding budget spreadsheet is your command center. It should track:

• Category

• Budgeted Amount

• Vendor Quote

• Deposit Paid

• Final Payment

• Budget vs Actual Cost Difference

Regular expense tracking here is non-negotiable to avoid overspending on wedding plans.

Regional and Contextual Intelligence for Global Families

Plan your child’s wedding on a budget with frugality requires changing to meet regional financial and cultural settings. One-size-fits–all strategy fails. In several situations, here’s how to use intelligence and thriftiness.

For Families in High-Cost, Developed Economies

In nations with high labor and service costs, the focus is on prioritization and sourcing alternatives.

- Priority-Based Spending: Direct money to the 2-3 aspects most important to your child (e.g., food, music) in accordance with priority. Cut ruthlessly somewhere else.

- The “Non-Traditional” Venue Advantage: Better worth than specialized wedding factories can be found in art galleries off-peak, university campuses, or private homes.

- Vendor Negotiation: bundle services—such as photography and videography from the same studio—with off-the-menu options.

- Focus on Experience Over Stuff: spend more on excellent food and music instead of elaborate gifts or complicated decorations.

For Families in Rapidly Developing Economies with Strong Traditions

Here, social expectations and inflation impact on wedding costs are significant challenges. The strategy blends respect for tradition with modern financial sense.

Leverage Local Sourcing: Flowers and decorations should be sourced from local marketplaces. Hire gifted local photographers working on their portfolio. For affordable wedding ideas, this is important.

Modernize Traditions Thoughtfully: Can one full, significant day be created from a multi-day event? Might a gold exchange be symbolic instead of large?

Community Contribution: It is customary in many civilizations for members of the extended family to present a skill, baking, singing, decor, as their present, hence lowering vendor expenses.

Negotiate with Respect but Firmness: Vendors’ prices are frequently changeable. At times, paying a substantial upfront deposit could get a reduced rate.

The Psychological and Relational Framework

To successfully plan your child’s marriage on a budget with frugality, you must navigate the emotional landscape as adeptly as the financial one.

How to Balance Emotions and Finances in Wedding Planning

1.Initiate Transparent Conversations Early: Early on, talk about the budget structure with your child and their spouse. Frame it as a creative challenge to build their true day, not as a constraint.

2.Separate “Needs” from “Wants”: Firstly, funded is the needs list. With whatever funds are left or inventive solutions, the wants list is met.

3.Practice Graceful Declination: Have a courteous, rehearsed reply for well-intended ideas that might blow the budget. That’s a lovely idea, but it contradicts our plans for a small meeting.

How to Plan Wedding Without Loans and Avoid Financial Regret

Debt is the antithesis of a frugal, joyful start. The mantra is: If we can’t pay for it in cash (from the dedicated corpus), we don’t book it.

- This calls for tight following of your marriage budget spreadsheet.

- It means making difficult decisions and maybe trimming the guest list or choosing a simpler menu.

- The reward is a day free from the shadow of future payments.

Frequently Asked Questions (FAQs):

Q1: How early should parents start saving for marriage?

Ideally, start official saving for a child’s wedding when they are small, even in early childhood. This makes use of compounding. Should begin late, anticipate a larger monthly investment need and think about changing the size of the wedding.

Q2: How much should I save for my child’s wedding?

There is no global number. You must rationally estimate marriage costs for your area and ambitions then add a sensible inflation index to arrive at your future wedding cost estimation. This is your savings aim.

Q3: What is the #1 tip to control wedding expenses?

Merciless guest list management. It’s the master variable impacting favor, venue, stationery, and catering expenses. Often more meaningful, a little, close wedding is the foundation of affordable wedding planning.

Q4: How can we have a nice wedding on a very tight budget?

Adopt an extremely prioritized approach. Splurge on one or two components (say, excellent food, an amazing photographer). For other things, think outside the box: DIY, digital, borrowed, or locally sourced. This is the core of how to plan a wedding under budget.

Q5: How do we handle family pressure to spend more?

Express your plan boldly: Instead of a big, expensive party, we have chosen a small, close-knit gathering with significant events. We would really be happy you will be there with us. This establishes a lovely, distinct boundary.

Conclusion: Plan Your Child’s Marriage on a Budget with Frugality

To plan your child’s marriage on a budget with frugality is to embark on a journey of mindful creation. It shifts the emphasis from simple spending to creating experience; from charming others to appreciating the couple. This method, combining ambitious financial goal setting with creative wedding planning on a budget—builds financial resiliency and family unity as well as a party.

Path is clearly defined: Start early for child’s marriage. Invest following a goal-based investing. Build an exact wedding budget breakdown. Do with a creative, economical mentality. For cost monitoring, use tools like a wedding budget spreadsheet. And planning your wedding without loans throughout to preserve the celebration’s delight.Bear in mind that seldom are the most treasured memories the most costly ones.

Those are the times of real link, love, and celebration, all of which are priceless and very accessible. By accepting the ideas in this book, you may provide your child the wonderful, sustainable, and happy start they deserve while protecting your own financial future. Start your child’s marriage planning right away with assurance and clarity.