How to Create a Budget as a Single Mom Step by Step

Let us be sincere for a while. The word “how to create a budget as a single mom” can feel overpowering, perhaps somewhat traumatic. It often brings to mind restrictions, spreadsheets, and remorse over that last “unnecessary” trip to the grocery shop for your child.

But what if I told you that budgeting for single moms is about creating a base of security for your family rather than about constructing a cage for your money? Having sat across the table from hundreds of single mothers, working, stay-at-home, divorced, widowed, and those navigating low-income circumstances, as a financial coach I have come to see that the most effective budget is the one that offers control, clarity, and, above all, peace of mind.

This book is not about theory. Based on actual life experience, it is a pragmatic, step-by-step roadmap. We will go over creating a single mom budget suited to your circumstances rather than those of someone else. From erratic childcare costs to juggling everything on one salary, we will address the particular difficulties of budgeting as a single parent.

I aim to provide you with a clear monthly budgeting method, assist you to view your entire financial picture, and create the financial confidence gained from knowing precisely where your money is spent. This is how you get financial security.

Why a Budget is Your Most Powerful Tool as a Single Mother

Before we dive into the numbers, let’s shift the mindset. A budget is not a report card on your parenting or your worth. It is a tool for:

- Predictability: Organizing financial turmoil into a strategy.

- Prioritizing: First of all, make certain your family’s essential expenses are always covered.

- Empowerment: Deliberately spending your money instead of feeling it vanishes.

- Goal Achievement: Whether it’s a little savings cushion, paying off debt, or saving for a family trip, a budget is how you arrive at your aim.

Financial planning for single moms begins with this basic awareness;

You are the head executive of your family. A CEO has to have a strategy to run. This is yours.

The Step-by-Step Guide to Creating Your Single Mom Budget

Simply said, every dollar has a job under our zero-based budgeting method. Your income less your costs equals zero. This means you have guided every dollar where to go, including toward savings, not that you have no money in the bank. Because it leaves nothing to chance, this approach is extremely effective for money management for single moms.

Step 1: Gather Your Financial Intel (The Full Financial Picture)

You can’t plan where you’re going if you don’t know where you are. For one month, commit to tracking everything.

- Gather Statements: Collect bills, pay stubs, bank statements, receipts.

- Use Tools: A basic notebook, a free app (like Mint or EveryDollar), or a spreadsheet.

- Track Every Dollar: That morning coffee, the five dollar app buy, the money you spent at the farmers market. Everything of it.

Step 2: List Your Income (All of It)

This forms the foundation of budgeting on one income. List all income sources received during a normal month. Make certain you mention:

- After taxes, your net income from your main work is

- Child support or alimony (if appropriate and trustworthy)

- Help from the government—SNAP, WIC, TANF

- Average it if your side gig or freelance revenue is erratic.

- Any other regular cash inflows

Pro Tip for Irregular Income: If your income fluctuates monthly (as it does for freelancers, servers, or gig employees), set your monthly budget on your lowest anticipated monthly income over the past six months. This is a very important flexible budgeting strategy. More on budgeting with irregular income will be covered later.

Realistic Example: Maria’s Income

- Full-Time Job (Net): $2,800

- Child Support: $400 (Note: She budgets this only when received)

- Total Budgetable Income (Base): $2,800

Step 3: List Your Expenses (The Heart of Your Budget)

Here’s where we build your budget categories. Start with the non-negotiables, the essential expenses that keep the roof over your head and the lights on.

Essential (Needs) Budget Categories:

- Housing Costs: Property Tax, renter’s insurance, rent/mortgage

- Utilities and Groceries: Electricity, gas, water, garbage, internet (a contemporary need for work/school), and a sensible food budget: Groceries and Utilities:

- Childcare Costs: after-school care, daycare, babysitting charges. Often a single mother’s next greatest cost after housing is this one.

- Transportation Budgeting: Car payments, gas, insurance, maintenance, or a public transportation pass make up a transportation budget.

- Healthcare: Copays, prescriptions, out-of-pocket expenses, insurance premiums.

- Minimum Debt Payments: The least amount due on credit cards, student loans, or personal loans is known as the minimum needed payment.

Non-Essential (Wants) & Future Categories:

- Savings & Emergency Fund: Not an afterthought, this is top priority. A start is $20.

- Personal & Kid Spending: haircuts, clothes, entertainment, little fun money.

- Miscellaneous: household products, school supplies, pet care.

Realistic Example: Maria’s Monthly Expenses

- Rent: $1,200

- Utilities (Elec/Gas/Water/Internet): $280

- Groceries: $500

- Childcare: $600

- Car Payment/Gas/Insurance: $350

- Health Insurance Copay: $50

- Minimum Credit Card Payment: $60

- Total Essentials: $3,040

- Savings Goal: $50

- Personal/Kids (Clothing, Fun): $100

Maria’s Reality Check: Her basic income ($2,800) is insufficient to pay her key needs ($3,040). Many single mothers experience this upsetting but essential moment of understanding. The budget shows the disparity she has to solve either by raising revenue, lowering expenditures, or budget adjustment.

Step 4: Assign Every Dollar a Job (Zero-Based Budgeting)

Now, subtract your expenses from your income. The goal is zero.

Money left over: Quickly give it a mission! Increase your emergency fund, pay more on debt, or support a little aim.

If you’re in the negative (like Maria): This is the signal for a single mother to prioritize expenses as a single mom. You need to modify it until the numbers balance.

Step 5: Prioritize and Adjust (The Reality Check)

This is where financial planning for single moms meets real life. You must prioritize ruthlessly.

- Cover the Four Walls First: Food, housing, electricity, and simple transportation. Until these are safe, nothing else is paid.

- Negotiate or Cut: Can you phone to lower a charge? Change to a more affordable phone plan? Cancel subscription services? Modulate food expenditures?

- Seek Community Support: To stretch your food budget, look at subsidized childcare costs, LIHEAP for utility assistance, or food pantries. This is tactical, not a failing.

- Increase Income (If Possible): Consider overtime, a side business, or skill training for a better-paying employment.

Maria’s Adjustment: Maria committed to a stricter meal plan (reduced groceries to $450), called her internet provider for a promotional rate (saved $20), and applied for a childcare voucher. She also launched a weekend babysitting side job for an additional $200 per month. Her revised budget balances.

Step 6: Track and Review (Consistency is Key)

A budget is a living document. Budget tracking is non-negotiable.

- Weekly Check-in: Record transactions. Apps can handle this automatically.

- Keep a Monthly Budget Meeting (With Yourself): Modify categories depending on what you have learned ahead of the new month. Did you plan gas money inadequately? Overbudget for fun? Modifications.

Special Considerations for Single Moms

How to Budget with Irregular Income

This is one of the biggest challenges in budgeting for single moms. The flexible budgeting method is your best friend.

- Find your baseline: Compute your mean monthly necessary expenditures as Steps 1–4 above. This is your survival number.

- Prioritize in Waves: Pay your fundamental costs first in a high-income month; then create a savings cushion—aim for 1–2 months’ worth of basic expenses—then pay more on debt or fund other objectives. You live off your cushion and stay entirely within baseline costs in a low-income month.

- Use a Buffer or Sinking Funds: Set aside a little each month in a different savings account for yearly costs (car insurance, back-to-school) using a buffer or sinking funds.

Involving Your Kids in Budgeting Discussions

Age-appropriate budgeting with kids teaches valuable life skills and reduces family financial stress.

- For Young Kids: Save for a family aim (like a pizza night) using a transparent jar. Talk about demands versus wants in the store.

- For Older Kids/Teens: Be open about trade-offs. “If we pick a more costly summer camp, we will have to eat out less this month.” Set them a little clothing budget to work from. This is strong financial education for single moms to pass on.

How to Build an Emergency Fund as a Single Mom

This is your financial oxygen mask. Begin modestly.

- $500. This covers a modest car repair or copay.

- Necessary Expenditures Over One Month

- 3–6 months of essentials. This demands time. Have regular and constant patience. Automatically transfer a small amount from every check into a special savings account.

Tackling Debt on a Single Income

Motivate yourself with the debt snowball method: write debts from smallest to greatest, make minimums on every, and throw any surplus money toward the least debt till it’s gone. The psychological victory drives momentum. Using your savings fund instead helps to avoid debt for future crises.

Common Budgeting Mistakes Single Moms Make (And How to Avoid Them)

- Not Budgeting for “Fun”: An unduly constrained budget always fails. For you and your children to prevent burnout, include modest, practical values.

- Forgetting Irregular Expenses: birthdays, Christmas, vehicle registration. Prepare monthly sinking funds for these.

- Comparing Your Budget to Others: Your circumstances are uncommon. Your funds should not be nearly so.

- Giving Up After One Bad Month: One overspend does not shatter a budget. It’s a way to let you reset. Just start next month clean.

Tools to Make Budgeting Easier

- Spreadsheets: Google Sheets offers free and highly customizable spreadsheets.

- Budgeting Apps: Mint, EveryDollar (free edition), YNAB (You Need A Budget – paid but highly effective for zero-based budgeting)

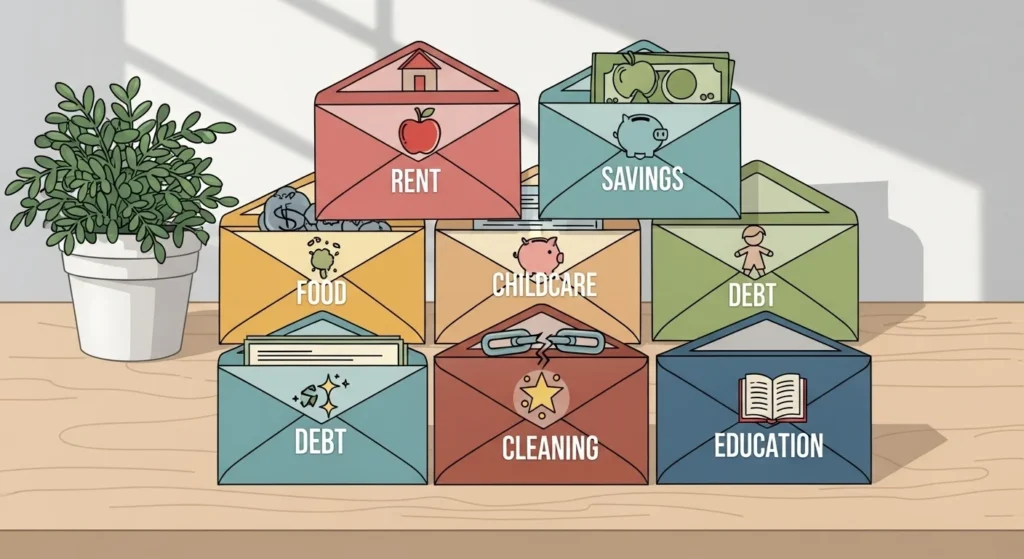

- The Envelope System: For variable categories such as entertainment and food, cash is best used. You stop when the money is gone.

- Your Bank’s Tools: Several provide spending categorizers and warnings among your bank’s resources.

FAQs: Budgeting Questions Single Moms Ask

Q1: What is the best budgeting method for single moms?

Usually most successful since it makes you accountable for every dollar and is quite flexible for irregular income, the zero-based budget Still, the best approach is the one you will always follow.

Q2: How do I create a monthly budget as a single mom when I’m living paycheck to paycheck?

Begin with the most fundamental level: for two weeks, record every penny. Then create a basic Four Walls budget. Any surplus is put to a small emergency fund. The first step in breaking the circle is stopping the hemorrhage and establishing a tiny buffer.

Q3: What are some budgeting tips for single moms with unpredictable income?

One needs a buffer when budgeting with irregular income. Live on income from last month as far as you can. Fund first your baseline for the following month in a high-earning month. This generates fake stability and lessens permanent stress.

Q4: How can I realistically save for an emergency fund as a single mom?

Begin with an automatic $20 per paycheck transfer. Consider it an unpaid debt. Using a bank service or app, round off your change. Until you reach your first $500, any windfall, tax refund, side gig bonus, should go straight toward this fund.

Q5: How do I budget for childcare costs as a single parent?

Consider it to be a premium fixed cost, much like your mortgage. Investigate all possibilities: subsidies, employer-dependent care FSAs, home-based daycares, co-oping with another parent, or modified working hours. Other budget decisions sometimes follow from this one.

Conclusion: Your Financial Stability Journey Starts Today

Creating a budget as a single mom shows great love and leadership. You are saying, “I see the obstacles and I am constructing a system to surmount them.” It won’t always be perfect. Months will pass when the vehicle malfunctions or a child’s growth spurt calls for new shoes, and the strategy goes out the window. That is okay. Financial stability comes from the tools, tenacity, and confidence one has to change, not from a flawless prediction.

You possess the fortitude derived from managing more than most others can envision. Channel that strength into your money management right now. Today start with the first step. Gather your facts. Record one month’s earnings and expenses. View your full financial picture. From that clarity will follow all else, the budget adjustments, the savings cushion, the debt snowball, the rising feeling of control.

You are creating a financial education and security legacy for your kids rather than merely existing. Begin at where you are. Make use of available resources. Do as much as you are able. Your path toward financial stability and peace of mind starts with one bold step: creating your budget.